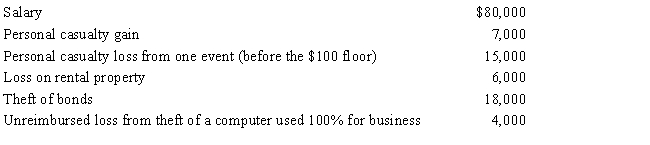

Gary, who is an employee of Red Corporation, has the following items for 2017:

Determine Gary's AGI and total amount of itemized deductions for 2017.

Determine Gary's AGI and total amount of itemized deductions for 2017.

Correct Answer:

Verified

Q104: What are the three methods of handling

Q107: Discuss the tax treatment of nonreimbursed losses

Q110: Milt, married and filing jointly, had the

Q112: Juan, married and filing jointly, had the

Q113: Discuss the treatment, including the carryback and

Q114: Ruth, age 66, sustains a net operating

Q116: Red Company is a proprietorship owned by

Q117: In 2016, Robin Corporation incurred the following

Q119: Nora, single, had the following income and

Q120: Susan has the following items for 2017:

∙

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents