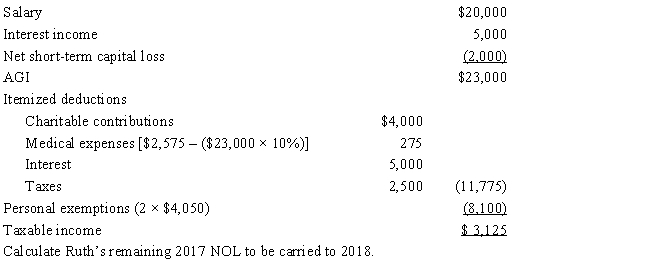

Ruth, age 66, sustains a net operating loss (NOL) of $15,000 for 2017. Because Ruth had no taxable income in 2015, the loss is carried back to 2016. For 2016, the joint income tax return of Ruth and her husband was as follows:

Correct Answer:

Verified

Q104: What are the three methods of handling

Q107: Discuss the tax treatment of nonreimbursed losses

Q109: Why was the domestic production activities deduction

Q110: Milt, married and filing jointly, had the

Q112: Juan, married and filing jointly, had the

Q113: Discuss the treatment, including the carryback and

Q115: Gary, who is an employee of Red

Q116: Red Company is a proprietorship owned by

Q117: In 2016, Robin Corporation incurred the following

Q119: Nora, single, had the following income and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents