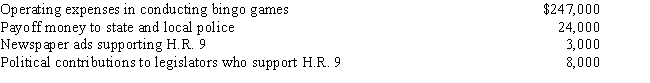

Rex, a cash basis calendar year taxpayer, runs a bingo operation which is illegal under state law. During 2017, a bill designated H.R. 9 is introduced into the state legislature which, if enacted, would legitimize bingo games. In 2017, Rex had the following expenses: Of these expenditures, Rex may deduct:

A) $247,000.

B) $250,000.

C) $258,000.

D) $282,000.

E) None of the above.

Correct Answer:

Verified

Q47: If a vacation home is classified as

Q60: Marsha is single, had gross income of

Q61: Which of the following legal expenses are

Q62: Which of the following may be deductible?

A)Bribes

Q65: During 2016, the first year of operations,

Q66: For a president of a publicly held

Q66: Which of the following are deductions for

Q67: Terry and Jim are both involved in

Q75: Which of the following is a required

Q77: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents