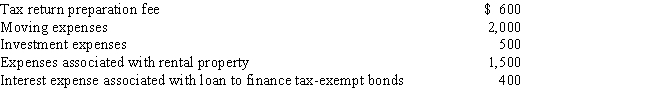

Cory incurred and paid the following expenses:  Calculate the amount that Cory can deduct (before any percentage limitations) .

Calculate the amount that Cory can deduct (before any percentage limitations) .

A) $5,000.

B) $4,600.

C) $3,000.

D) $1,500.

E) None of the above.

Correct Answer:

Verified

Q81: Which of the following is not a

Q84: Beige, Inc., an airline manufacturer, is conducting

Q93: Nikeya sells land (adjusted basis of $120,000)

Q94: Alfred's Enterprises, an unincorporated entity, pays employee

Q95: If a residence is used primarily for

Q97: Which of the following is not deductible?

A)Moving

Q100: Which of the following is not relevant

Q101: Taylor, a cash basis architect, rents the

Q102: While she was a college student, Angel

Q105: Marvin spends the following amounts on a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents