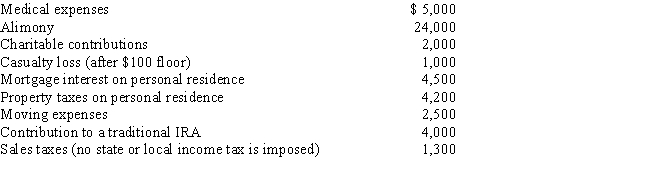

Austin, a single individual with a salary of $100,000, incurred and paid the following expenses during the year:

Calculate Austin's deductions for AGI.

Calculate Austin's deductions for AGI.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q61: Which of the following is incorrect?

A) Alimony

Q74: Tommy, an automobile mechanic employed by an

Q76: Iris, a calendar year cash basis taxpayer,

Q77: Tom operates an illegal drug-running operation and

Q80: Paula is the sole shareholder of Violet,

Q83: In January, Lance sold stock with a

Q83: Velma and Bud divorced. Velma's attorney fee

Q84: For an activity classified as a hobby,

Q85: Which of the following must be capitalized

Q86: Priscella pursued a hobby of making bedspreads

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents