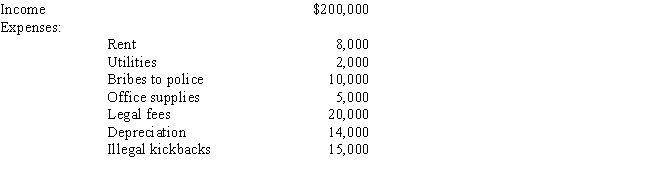

Kitty runs a brothel (illegal under state law) and has the following items of income and expense. What is the amount that she must include in taxable income from her operation?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q100: Robin and Jeff own an unincorporated hardware

Q107: During the year, Martin rented his vacation

Q109: Petula's business sells heat pumps which have

Q110: Agnes operates a Christmas Shop in Atlantic

Q111: Janet is the CEO for Silver, Inc.,

Q112: Arnold and Beth file a joint return.

Q115: During the year, Rita rented her vacation

Q116: In order to protect against rent increases

Q118: Bridgett's son, Clyde, is $12,000 in arrears

Q120: Walter sells land with an adjusted basis

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents