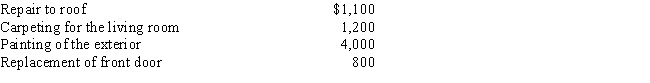

Marvin spends the following amounts on a house he owns:

a.How much of these expenses can Marvin deduct if the house is his principal residence?

b.How much of these expenses can Marvin deduct if he rents the house to a tenant?

c.Classify any deductible expenses as deductions for AGI or as deductions from AGI.

Correct Answer:

Verified

Q84: Beige, Inc., an airline manufacturer, is conducting

Q94: Alfred's Enterprises, an unincorporated entity, pays employee

Q100: Cory incurred and paid the following expenses:

Q101: Taylor, a cash basis architect, rents the

Q102: While she was a college student, Angel

Q106: Albie operates an illegal drug-running business and

Q107: Mattie and Elmer are separated and are

Q109: Petula's business sells heat pumps which have

Q118: Bridgett's son, Clyde, is $12,000 in arrears

Q120: Walter sells land with an adjusted basis

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents