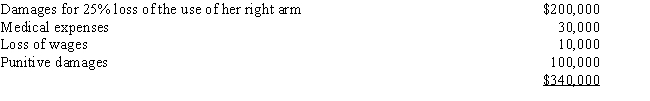

Barbara was injured in an automobile accident. She has threatened to file a suit against the other party involved in the accident and has proposed the following settlement:

The defendant's insurance company is reluctant to pay punitive damages. Also, the company disputes the amount of her loss of wages amount. Instead, the company offers to pay her $300,000 for damages to her arm and $30,000 medical expenses. Assuming Barbara is in the 35% marginal tax bracket, will her after-tax proceeds from accepting the offer be equal to what she considers to be her actual damages (listed above)?

The defendant's insurance company is reluctant to pay punitive damages. Also, the company disputes the amount of her loss of wages amount. Instead, the company offers to pay her $300,000 for damages to her arm and $30,000 medical expenses. Assuming Barbara is in the 35% marginal tax bracket, will her after-tax proceeds from accepting the offer be equal to what she considers to be her actual damages (listed above)?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q89: In the case of interest income from

Q91: Doug and Pattie received the following interest

Q92: In December 2017, Todd, a cash basis

Q93: Heather's interest and gains on investments for

Q94: Sandy is married, files a joint return,

Q97: George is employed by the Quality Appliance

Q98: George, an unmarried cash basis taxpayer, received

Q99: On January 1, 2007, Cardinal Corporation issued

Q100: Tonya is a cash basis taxpayer. In

Q101: Sonja is a United States citizen who

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents