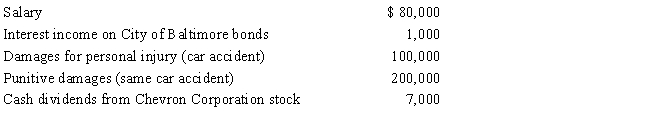

During 2017, Sarah had the following transactions: Sarah's AGI is:

A) $185,000.

B) $187,000.

C) $285,000.

D) $287,000.

E) $387,000.

Correct Answer:

Verified

Q62: When the kiddie tax applies, the child

Q62: Frank sold his personal use automobile for

Q64: Which, if any, of the following statements

Q73: Which, if any, of the statements regarding

Q74: During 2017, Marvin had the following transactions:

Q79: During 2017, Esther had the following transactions:

Q79: Which of the following items, if any,

Q82: Millie, age 80, is supported during the

Q83: The Hutters filed a joint return for

Q97: A qualifying child cannot include:

A)A nonresident alien.

B)A

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents