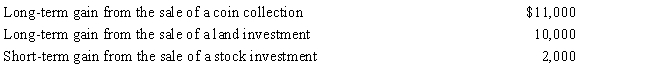

Kirby is in the 15% tax bracket and had the following capital asset transactions during 2017: Kirby's tax consequences from these gains are as follows:

A) (5% × $10,000) + (15% × $13,000) .

B) (15% × $13,000) + (28% × $11,000) .

C) (0% × $10,000) + (15% × $13,000) .

D) (15% × $23,000) .

E) None of these.

Correct Answer:

Verified

Q111: In 2017, Ashley earns a salary of

Q112: During the year, Irv had the following

Q113: Meg, age 23, is a full-time law

Q114: Homer (age 68) and his wife Jean

Q115: Heloise, age 74 and a widow, is

Q117: For the current year, David has wages

Q118: During 2017, Trevor has the following capital

Q119: Taylor had the following transactions for 2017:

What

Q120: In 2017, Tom is single and has

Q152: During the current year, Doris received a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents