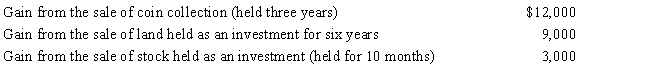

During 2017, Jackson had the following capital gains and losses:

a.How much is Jackson's tax liability if he is in the 15% tax bracket?

b.If his tax bracket is 33% (not 15%)?

Correct Answer:

Verified

Q129: Jayden and Chloe Harper are husband and

Q130: During 2017, Madison had salary income of

Q131: When filing their Federal income tax returns,

Q132: In order to claim a dependency exemption

Q134: In satisfying the support test and the

Q135: Lena is 66 years of age, single,

Q136: In meeting the criteria of a qualifying

Q137: When can a taxpayer not use Form

Q146: Mel is not quite sure whether an

Q156: The Dargers have itemized deductions that exceed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents