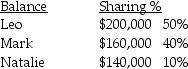

The Leo,Mark and Natalie Partnership had the following capital balances and profit/loss sharing percentages:

Newsome is going to buy into the partnership by paying $200,000 for a 20% ownership in the partnership.

Newsome is going to buy into the partnership by paying $200,000 for a 20% ownership in the partnership.

Required:

1.If Newsome pays the partnership directly,what are the four partner capital balances immediately following Newsome's admission to the partnership using the bonus method? Assume the partnership assets are not revalued.

2.If Newsome pays the partnership directly,what are the four partner capital balances immediately following Newsome's admission to the partnership using the goodwill method? Assume the partnership assets are revalued.The $200,000 amount paid by Newsome is fair value for a 20% share of the partnership.

Correct Answer:

Verified

If Newsome pays the partne...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q35: A summary balance sheet for the Uma,Van,and

Q36: Greta,Harriet,and Ivy have a retail partnership business

Q37: A summary balance sheet for the partnership

Q38: Required:

1.Prepare a schedule to allocate income or

Q39: The profit and loss sharing agreement for

Q41: When a partner dissociates from the partnership,the

Q42: When partners withdraw money on a weekly

Q43: Partnerships do not pay federal taxes but

Q44: When a new partner joins the partnership,the

Q45: In the absence of a partnership agreement,profit

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents