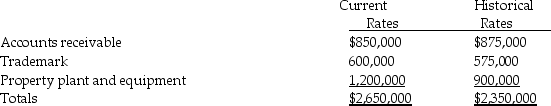

The following assets of Poole Corporation's Romanian subsidiary have been converted into U.S.dollars at the following exchange rates:  Assume the functional currency of the subsidiary is the U.S.dollar and the books are kept in a different currency.The assets should be reported in the consolidated financial statements of Poole Corporation and Subsidiary in the total amount of

Assume the functional currency of the subsidiary is the U.S.dollar and the books are kept in a different currency.The assets should be reported in the consolidated financial statements of Poole Corporation and Subsidiary in the total amount of

A) $2,325,000.

B) $2,350,000.

C) $2,375,000.

D) $2,650,000.

Correct Answer:

Verified

Q10: Assume the functional currency of a foreign

Q11: Which of the following foreign subsidiary accounts

Q12: Accounts representing an allowance for uncollectible accounts

Q13: A U.S.parent corporation loans funds to a

Q14: Exchange gains or losses from remeasurement appear

A)in

Q16: Pelmer has a foreign subsidiary,Sapp Corporation of

Q17: The primary goal behind consolidating financial statements

Q18: Which of the following statements about the

Q19: A foreign entity is a subsidiary of

Q20: Paskin Corporation's wholly-owned Canadian subsidiary has a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents