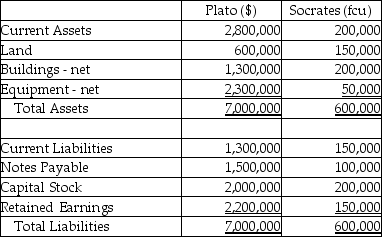

Plato Corporation,a U.S.company,purchases all of the outstanding stock of Socrates Company,which operates outside the U.S.on January 1,2014.Socrates' net assets have fair values that equal their book values with the exception of land that has a fair value of 200,000 foreign currency units and equipment with a fair value of 100,000 foreign currency units.Plato paid $180,000 for this acquisition.The balance sheets for Plato and Socrates are shown below just before the business combination.Socrates' functional currency is the foreign currency unit (fcu)and the exchange rate at the date of acquisition was $.40 per fcu.Socrates uses the fcu for record-keeping purposes.

Required:

Required:

Prepare a consolidated balance sheet for Plato and subsidiary at January 1,2014 immediately following the business combination.

Correct Answer:

Verified

Q32: Skillet Corporation,a British subsidiary of Pan

Q33: On January 1,2014,Placid Corporation acquired a 40%

Q34: Pan Corporation,a U.S.company,formed a British subsidiary on

Q35: On January 1,2014,Pilgrim Corporation,a U.S.firm,acquired ownership of

Q36: The Polka Corporation,a U.S.corporation,formed a British

Q38: Each of the following accounts has been

Q39: Puddle Incorporated purchased an 80% interest in

Q40: On January 1,2014,Psalm Corporation purchased all the

Q41: When all elements of the financial statements

Q42: For foreign subsidiaries whose functional currency is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents