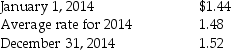

On January 1,2014,Paste Unlimited,a U.S.company,acquired 100% of Sticky Corporation of Italy,paying an excess of 112,500 euros over the book value of Sticky's net assets.The excess was allocated to undervalued equipment with a five year remaining useful life.Sticky's functional currency is the euro,and the books are kept in euros.Exchange rates for the euro for 2014 are:

Required:

Required:

1.Determine the depreciation expense on the excess allocated to equipment for 2014 in U.S.dollars.

2.Determine the unamortized excess allocated to equipment on December 31,2014 in U.S.dollars.

3.If Sticky's functional currency was the U.S.dollar,what would be the depreciation expense on the excess allocated to the equipment for 2014?

Correct Answer:

Verified

Depreciation expense in 20...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: Stripe Corporation,a British subsidiary of Polka

Q26: Par Industries,a U.S.Corporation,purchased Slice Company of New

Q27: Pew Corporation (a U.S.corporation)acquired all of the

Q28: For each of the 12 accounts listed

Q29: On January 1,2014,Planet Corporation,a U.S.company,acquired 100% of

Q31: Phim Inc.,a U.S.company,owns 100% of Sera Corporation,a

Q32: Skillet Corporation,a British subsidiary of Pan

Q33: On January 1,2014,Placid Corporation acquired a 40%

Q34: Pan Corporation,a U.S.company,formed a British subsidiary on

Q35: On January 1,2014,Pilgrim Corporation,a U.S.firm,acquired ownership of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents