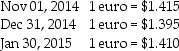

On November 1,2014,Ross Corporation,a calendar-year U.S.corporation,invested in a purely speculative contract to purchase 1 million euros on January 30,2015,from Trattoria Company,an Italian brokerage firm.Ross agreed to purchase 1,000,000 euros from Trattoria at a fixed price of $1.420 per euro.Trattoria agreed to transmit 1,000,000 euros to Ross on January 30,2015.Net settlement is not permitted.The spot rates for euros are:

The 30-day futures rate for euros on December 31,2014 was $1.405.

The 30-day futures rate for euros on December 31,2014 was $1.405.

Required:

Prepare the General Journal entries that Ross would record on November 1,December 31,and January 30.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Use the following information to answer the

Q17: Which of the following hedging strategies would

Q18: On May 1,2014,Listing Corporation receives inventory items

Q19: A forward contract used as a cash

Q20: When a cash flow hedge is appropriate,the

Q22: Slickton Corporation,a U.S.holding company,enters into a forward

Q23: On June 1,2014,Dapple Industries purchases an option

Q24: On November 1,2013,Stateside Company (a U.S.manufacturer)sold an

Q25: Ferb Company is a U.S.-based importer of

Q26: Onoly Corporation (a U.S.manufacturer)sold parts to its

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents