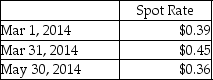

On March 1,2014,Amber Company sold goods to a foreign customer at a price of 50,000 foreign currency units.The customer will pay in three months.At the time of the sale,Amber paid $2,000 to acquire an option to sell 50,000 foreign currency units in three months at the strike price of $0.39.On May 30,2014,the customer sent in 50,000 foreign currency units.Quarterly financial reports are prepared on March 31.Ignore the time value of money.Relevant exchange rates are as follows:

Required:

Required:

Prepare the journal entries required for these transactions,if the foreign currency option is designated as a fair value hedge.

Correct Answer:

Verified

Q33: On November 1,2014,Moddel Company (a U.S.corporation)entered into

Q34: Opie Industries is a manufacturer of plastic

Q35: On January 1,2014,Bosna borrowed $100,000 from Lenda.The

Q36: On November 1,2014,Portsmith Corporation,a calendar-year U.S.corporation,invested in

Q37: On November 1,2013,Mayberry Corporation,a U.S.corporation,purchased from Cantata

Q39: Ivan has 14,000 barrels of oil

Q40: On December 18,2014,Wabbit Corporation (a U.S.Corporation)has a

Q41: If an existing asset is being hedged,it

Q42: FASB ASC Topic 830 requires marking to

Q43: A cash-flow hedge attempts to limit a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents