Use the following information to answer the question(s) below.

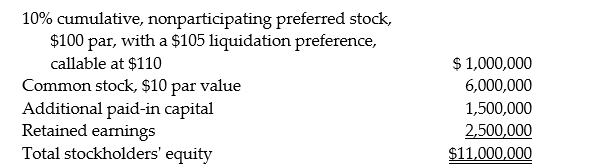

On January 1, 2014, Pardy Corporation acquired a 70% interest in the common stock of Salter Corporation for $7,000,000 when Salter's stockholders' equity was as follows: There were no preferred dividends in arrears on January 1, 2014. There are no book value/fair value differentials.

There were no preferred dividends in arrears on January 1, 2014. There are no book value/fair value differentials.

-What is the implied goodwill for Salter based on Pardy's purchase price for Salter on January 1,2014?

A) $0

B) $35,000

C) $70,000

D) $100,000

Correct Answer:

Verified

Q2: Use the following information to answer the

Q3: When a subsidiary has preferred stock that

Q4: Palmquist Corporation and its 80%-owned subsidiary,Sadler Corporation,are

Q5: Palmer Company owns a 25% interest in

Q6: Palm owns a 70% interest in Sable,a

Q8: In computing consolidated diluted EPS,the replacement calculation

Q9: If a parent company has controlling interest

Q10: Use the following information to answer the

Q11: Use the following information to answer the

Q12: Use the following information to answer the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents