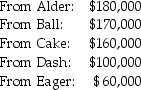

Pane Corporation owns 100% of Alder Corporation,85% of Ball Corporation,70% of Cake Corporation,40% of Dash Corporation,and 10% of Eager Corporation.All of these corporations are domestic corporations.Pane,Alder and Ball belong to an affiliated group.Pane's marginal income tax rate is 35%.All investees have paid out all their net income in the form of dividends.During 2014,Pane Corporation received the following cash dividends:

Required:

Required:

1.Compute the amount of the dividend income that would be excluded from taxation under the current Internal Revenue Code.

2.Compute Pane's current income tax liability for the dividend income received in 2014.

Correct Answer:

Verified

Excluded dividend income:

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q28: Parker Corporation owns an 80% interest in

Q29: Saito Corporation's stockholders' equity on December 31,2014

Q30: Sally Corporation's stockholders' equity on December 31,2014

Q31: Savy Corporation's stockholders' equity on December

Q32: Samford Corporation's stockholders' equity on December 31,2014

Q34: Peyton Corporation owns an 80% interest in

Q35: Pretax operating incomes of Pang Corporation

Q36: The call or redemption price of preferred

Q37: Stello Corporation's stockholders' equity on December 31,2014

Q38: Sandy Corporation's stockholders' equity on December

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents