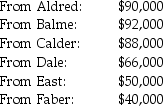

Paradise Corporation owns 100% of Aldred Corporation,90% of Balme Corporation,80% of Calder Corporation,75% of Dale Corporation,20% of East Corporation,and 8% of Faber Corporation.Paradise,Aldred,Balme and Calder belong to an affiliated group.All of these corporations are domestic corporations.During 2014,Paradise Corporation reports net income of $1,500,000.This net income includes the full amount of dividends received from Aldred and Faber,but does not include the dividends received from Balme,Calder,Dale,and East Corporations.All investees have paid out all of their net income in the form of dividends.Paradise's share of the various dividend distributions is as follows:

Required:

Required:

Calculate the correct amount of taxable income for Paradise Corporation if a consolidated tax return is filed.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: All dividends in arrears on cumulative preferred

Q22: Pancino Corporation owns a 90% interest in

Q23: Net income of an investee with preferred

Q24: Peter Corporation owns 90% of the common

Q25: Jeff Corporation owns 90% of the common

Q27: Pandy Corporation owns a 90% interest in

Q28: Parker Corporation owns an 80% interest in

Q29: Saito Corporation's stockholders' equity on December 31,2014

Q30: Sally Corporation's stockholders' equity on December 31,2014

Q31: Savy Corporation's stockholders' equity on December

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents