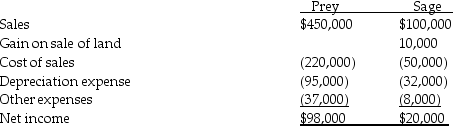

Prey Corporation created a wholly owned subsidiary,Sage Corporation,on January 1,2013,at which time Prey sold land with a book value of $90,000 to Sage at its fair market value of $140,000.Also,on January 1,2013,Prey sold to Sage equipment with a book value of $130,000 and a selling price of $165,000.The equipment had a remaining useful life of 4 years and is being depreciated under the straight-line method.The equipment has no salvage value.On January 1,2015,Sage resold the land to an outside entity for $150,000.Sage continues to use the equipment purchased from Prey.Income statements for Prey and Sage for the year ended December 31,2015 are summarized below:

Required:

Required:

At what amounts did the following items appear on the consolidated income statement for Prey and Subsidiary for the year ended December 31,2015?

1.Gain on Sale of Land

2.Depreciation Expense

3.Consolidated net income

4.Controlling interest share of consolidated net income

Correct Answer:

Verified

The gain on the sale of th...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: Pierce Manufacturing owns all of the outstanding

Q23: Paula's Pizzas purchased 80% of their supplier,Sarah's

Q24: Piglet Incorporated purchased 90% of the outstanding

Q25: Pigeon Company owns 80% of the outstanding

Q26: Porter Corporation acquired 70% of the outstanding

Q28: On January 2,2014,Pal Corporation sold warehouse equipment

Q29: An intercompany gain or loss appears in

Q30: Separate income statements of Plantation Corporation and

Q31: Plower Corporation acquired all of the outstanding

Q32: Snow Company is a wholly owned subsidiary

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents