Palmer Corporation purchased 75% of Stone Industries' common stock on January 2,2012.On January 1,2013,Stone sold equipment to Palmer that had a net book value of $16,000 and an original cost of $24,000 for $20,000.On January 1,2013,Palmer sold a building to Stone that had a net book value of $200,000 and an original cost of $250,000 for $300,000.The equipment had a remaining useful life of 8 years,and the building had a remaining useful life of 20 years.Neither asset had salvage value.Both companies use straight-line depreciation.

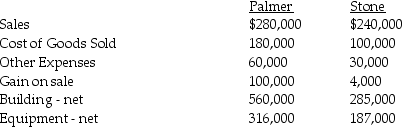

Selected account balances are shown below for Palmer and Stone for the year ended December 31,2013:

Required:

Required:

1.Prepare the consolidating working paper entries relating to the equipment and building for the year ended December 31,2013.

2.Calculate the following balances for the year ended December 31,2013:

A.Consolidated "Other Expenses"

B.Consolidated Buildings

C.Consolidated Equipment

D.Noncontrolling interest in Stone's net income

Correct Answer:

Verified

A.Conso...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Peregrine Corporation acquired an 80% interest in

Q17: Pigeon Corporation purchased land from its 60%-owned

Q18: Use the following information to answer the

Q19: Pied Imperial Corporation acquired a 90% interest

Q20: Use the following information to answer the

Q22: Pierce Manufacturing owns all of the outstanding

Q23: Paula's Pizzas purchased 80% of their supplier,Sarah's

Q24: Piglet Incorporated purchased 90% of the outstanding

Q25: Pigeon Company owns 80% of the outstanding

Q26: Porter Corporation acquired 70% of the outstanding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents