Paulee Corporation paid $24,800 for an 80% interest in Sergio Corporation on January 1,2013,at which time Sergio's stockholders' equity consisted of $15,000 of Common Stock and $6,000 of Retained Earnings.The fair values of Sergio Corporation's assets and liabilities were identical to recorded book values when Paulee acquired its 80% interest.

Sergio Corporation reported net income of $4,000 and paid dividends of $2,000 during 2013.

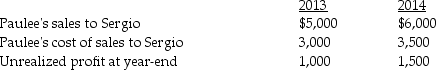

Paulee Corporation sold inventory items to Sergio during 2013 and 2014 as follows:

At December 31,2014,the accounts payable of Sergio include $1,500 owed to Paulee for inventory purchases.

At December 31,2014,the accounts payable of Sergio include $1,500 owed to Paulee for inventory purchases.

Required:

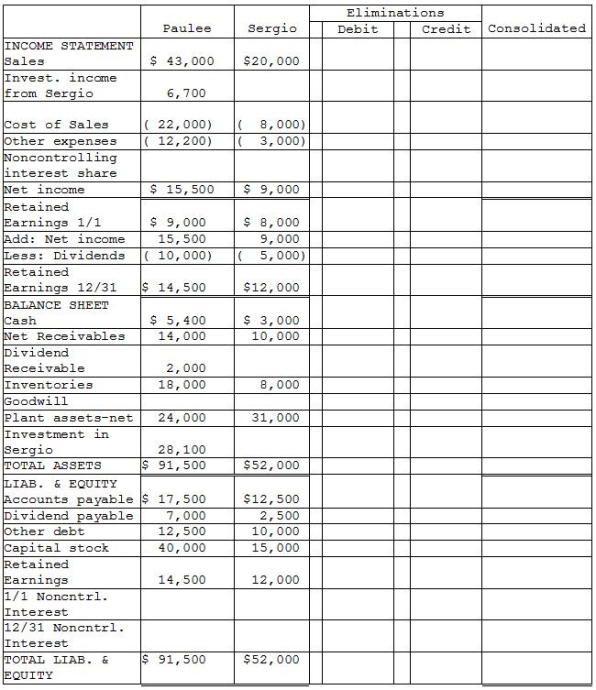

Financial statements of Paulee and Sergio appear in the first two columns of the partially completed working papers.Complete the consolidation working papers for Paulee Corporation and Subsidiary for the year ended December 31,2014.

Correct Answer:

Verified

Q35: Proman Manufacturing owns a 90% interest in

Q36: Pexo Industries purchases the majority of their

Q37: Pittle Corporation acquired an 80% interest in

Q38: Perry Instruments International purchased 75% of the

Q39: Plateau Incorporated bought 60% of the common

Q41: Revenue is recognized when it is earned;

Q42: If a subsidiary is a 100 percent-owned

Q43: The elimination entry for unrealized profit is

Q44: The ending inventory of the purchasing affiliate

Q45: Sales by a subsidiary to its parent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents