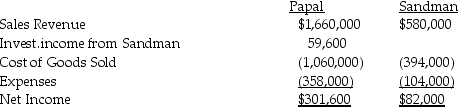

Papal Corporation acquired an 80% interest in Sandman Corporation at a cost equal to 80% of the book value of Sandman's net assets in 2013.At the time of the acquisition,the book values and fair values of Sandman's assets and liabilities were equal.During 2014,Papal recorded sales of $440,000 of merchandise to Sandman at a gross profit rate of 30%.Sandman's beginning and ending inventories for 2014 were $60,000 and $80,000,respectively.Income statement information for both companies for 2014 is as follows:

Required:

Required:

Prepare a consolidated income statement for Papal Corporation and Subsidiary for 2014.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: Use the following information to answer the

Q21: Presented below are several figures reported for

Q22: On January 1,2014,Paar Incorporated paid $38,500 for

Q23: Pfeifer Corporation acquired an 80% interest in

Q24: Pastern Industries has an 80% ownership stake

Q26: PreBuild Manufacturing acquired 100% of Shoding Industries

Q27: Plover Corporation acquired 80% of Sink Inc.equity

Q28: Preen Corporation acquired a 60% interest in

Q29: Penguin Corporation acquired a 60% interest in

Q30: Psalm Enterprises owns 90% of the outstanding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents