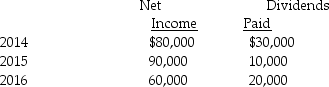

On January 1,2014,Paisley Incorporated paid $300,000 for 60% of Smarnia Company's outstanding capital stock.Smarnia reported common stock on that date of $250,000 and retained earnings of $100,000.Plant assets,which had a five-year remaining life,were undervalued in Smarnia's financial records by $10,000.Smarnia also had a patent that was not on the books,but had a market value of $60,000.The patent has a remaining useful life of 10 years.Any remaining fair value/book value differential is allocated to goodwill.Smarnia's net income and dividends paid the first three years that Paisley owned them are shown below.

Requirement 1: Calculate the noncontrolling interest share in Smarnia's income for each of the three years.

Requirement 1: Calculate the noncontrolling interest share in Smarnia's income for each of the three years.

Requirement 2: Calculate the noncontrolling interest that should be reported on the consolidated balance sheet at the end of each of the three years.

Requirement 3: Assuming that Paisley uses the equity method to record their investment in Smarnia,calculate the ending balance in the Investment in Smarnia account for each of the three years.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q31: Pommu Corporation paid $78,000 for a 60%

Q32: Adjustments made for consolidation statements impact both

Q33: Puddle Corporation acquired all the voting stock

Q34: Pull Incorporated and Shove Company reported summarized

Q35: On January 2,2014,Paleon Packaging purchased 90% of

Q37: Platt Corporation paid $87,500 for a 70%

Q38: On January 2,2014,PBL Enterprises purchased 90% of

Q39: Powell Corporation acquired 90% of the voting

Q40: Flagship Company has the following information collected

Q41: Proceeds from the sale of land are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents