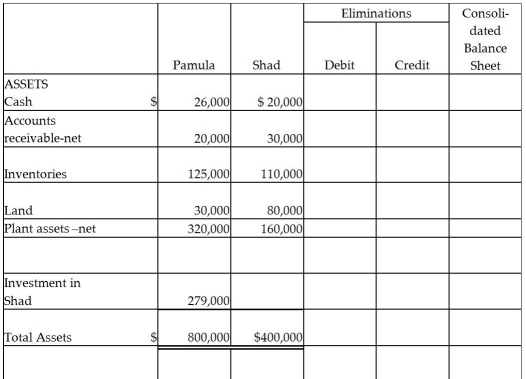

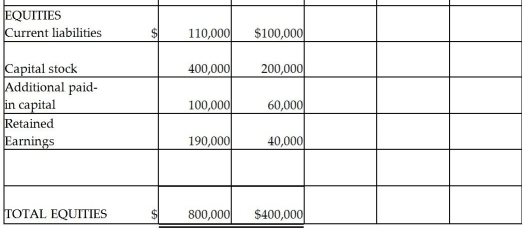

Pamula Corporation paid $279,000 for 90% of Shad Corporation's $10 par common stock on December 31,2014,when Shad Corporation's stockholders' equity was made up of $200,000 of Common Stock,$60,000 Additional Paid-in Capital and $40,000 of Retained Earnings.Shad's identifiable assets and liabilities reflected their fair values on December 31,2014,except for Shad's inventory which was undervalued by $5,000 and their land which was undervalued by $2,000.Balance sheets for Pamula and Shad immediately after the business combination are presented in the partially completed working papers.

Required:

Required:

Complete the consolidated balance sheet working papers for Pamula Corporation and Subsidiary.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q19: Push-down accounting

A)requires a subsidiary to use the

Q20: Pinata Corporation acquired an 80% interest in

Q21: On January 1,2014,Myna Corporation issued 10,000 shares

Q22: Petra Corporation paid $500,000 for 80% of

Q23: Polaris Incorporated purchased 80% of The Solar

Q25: On July 1,2014,Polliwog Incorporated paid cash for

Q26: Pal Corporation paid $5,000 for a 60%

Q27: Pool Industries paid $540,000 to purchase 75%

Q28: On January 2,2014,Power Incorporated paid $630,000 for

Q29: Passcode Incorporated acquired 90% of Safe Systems

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents