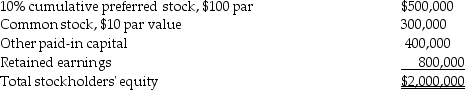

Plum Corporation paid $700,000 for a 40% interest in Satin Company on January 1,2013 when Plum's stockholders' equity was as follows:

On this date,the book values of Plum's assets and liabilities equaled their fair values and there were no dividends in arrears.

On this date,the book values of Plum's assets and liabilities equaled their fair values and there were no dividends in arrears.

Required: Calculate the amount recorded in the Investment in Satin Company and the amount of implied Goodwill in this transaction.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q18: The income from an equity method investee

Q19: In reference to intercompany transactions between an

Q20: Use the following information to answer the

Q21: On January 1,2013,Petrel,Inc.purchased 70% of the outstanding

Q22: Pearl Corporation paid $150,000 on January 1,2013

Q24: Wader's Corporation paid $120,000 for a 25%

Q25: Shebing Corporation had $80,000 of $10 par

Q26: On January 1,2013,Pendal Corporation purchased 25% of

Q27: On January 1,2013,Platt Corporation purchased a 30%

Q28: Pike Corporation paid $100,000 for a 10%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents