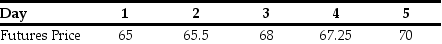

Your oil refinery will need to buy 250,000 barrels of crude oil in one week and it is worried about crude oil prices. Suppose you go long 250 crude oil futures contracts, each for 1000 barrels of crude oil, at the current futures price of $68 per barrel. Suppose futures prices change each day over the next week as follows:

What is the daily and cumulative marked to market profit or loss (in dollars) that you will have on each of the next five days?

What is the daily and cumulative marked to market profit or loss (in dollars) that you will have on each of the next five days?

Correct Answer:

Verified

Q29: A steel maker needs 5,000,000 tons of

Q30: A manufacturer of breakfast cereal is concerned

Q31: The duration of a five-year bond with

Q32: Which of the following statements regarding futures

Q33: What is the duration of a five-year

Q34: An interest rate that adjusts to current

Q34: What are some of the disadvantages of

Q38: Which of the following is an agreement

Q41: Which of the following statements is FALSE?

A)The

Q51: Luther Industries needs to borrow $50 million

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents