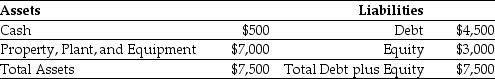

Use the table for the question(s) below.

Luther Industries currently has the following balance sheet (in Thousands of dollars) :

Luther is about to add a new fleet of delivery trucks. The price of the fleet is $1.5 million.

Luther is about to add a new fleet of delivery trucks. The price of the fleet is $1.5 million.

-Suppose the lease is a five-year fair market value lease, and the trucks have a remaining useful life of 8 years. If the monthly lease payments are $25,000 and the appropriate discount rate is 6% APR with monthly compounding, will the lease be classified as an operating lease or a capital lease for the lessee?

A) Capital lease, because the title to the property transfers to the lessee at the end of the lease term.

B) Capital lease, because the present value of the minimum lease payments at the start of the lease is 90% or more of the asset's fair value.

C) Operating lease, because the present value of the minimum lease payments at the start of the lease is less than 90% of the asset's fair value.

D) Operating lease, because the lease term is more than 75% of the estimated economic life of the asset.

Correct Answer:

Verified

Q16: Which of the following statements is FALSE?

A)If

Q26: Use the information for the question(s) below.

St.

Q27: Use the table for the question(s)below.

Luther Industries

Q28: Use the table for the question(s) below.

Luther

Q30: Which of the following statements is FALSE?

A)We

Q32: Use the information for the question(s) below.

St.

Q32: Use the information for the question(s)below.

St.Martin's Hospital

Q33: Use the table for the question(s) below.

Luther

Q37: Which of the following statements regarding leases

Q38: Which of the following statements is FALSE?

A)Lease

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents