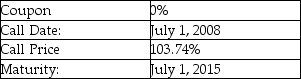

A firm issues the convertible debt shown above. The price of stock in this company on July 1, 2008 is $27.24. What is the minimum conversion ratio that would make a bondholder prefer to convert rather than accept the call price?

A firm issues the convertible debt shown above. The price of stock in this company on July 1, 2008 is $27.24. What is the minimum conversion ratio that would make a bondholder prefer to convert rather than accept the call price?

A) 33 shares per $1,000 principal amount

B) 36 shares per $1,000 principal amount

C) 38 shares per $1,000 principal amount

D) 42 shares per $1,000 principal amount

Correct Answer:

Verified

Q41: Which of the following statements is FALSE?

A)The

Q45: Which of the following statements is FALSE

Q52: Which of the following statements is FALSE?

A)When

Q91: When a callable bond sells at a

Q92: A callable bond will typically have a

Q94: A company issues a 20-year, callable bond

Q95: Which of the following is a type

Q97: What are callable bonds?

Q98: A convertible bond has a face value

Q101: What is yield to worst?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents