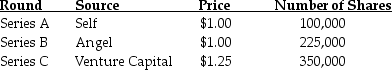

The founders and owners of a private company have funded it through the following rounds of investment:  The owners decide to take the company public through an IPO, issuing 1 million new shares. Assuming that they successfully complete the IPO, the net income for the next year is estimated to be $6 million. The price of shares is set using average price-earnings ratios for similar businesses of 15. What portion of the company will be owned by the angel investor after the IPO?

The owners decide to take the company public through an IPO, issuing 1 million new shares. Assuming that they successfully complete the IPO, the net income for the next year is estimated to be $6 million. The price of shares is set using average price-earnings ratios for similar businesses of 15. What portion of the company will be owned by the angel investor after the IPO?

A) 10%

B) 13%

C) 19%

D) 24%

Correct Answer:

Verified

Q20: Which of the following statements is FALSE?

A)The

Q42: Which of the following statements is FALSE?

A)

Q43: What is the major reason that underwriters

Q44: Which of the following statements regarding firm

Q45: The founder of a company currently holds

Q46: Which of the following is an activity

Q48: Which of the following statements is FALSE?

A)

Q50: Which of the following statements is FALSE?

A)

Q51: Luther Industries is in the process of

Q52: In its IPO, Jillian's Imprints, a small

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents