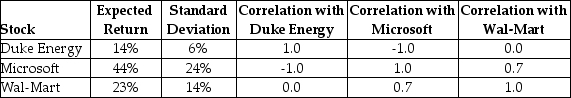

Consider the following expected returns, volatilities, and correlations:  The volatility of a portfolio that is equally invested in Duke Energy and Microsoft is closest to ________.

The volatility of a portfolio that is equally invested in Duke Energy and Microsoft is closest to ________.

A) 8.1%

B) 9.0%

C) 10.8%

D) 5.4%

Correct Answer:

Verified

Q43: Use the table for the question(s) below.

Consider

Q44: Consider the following returns: Q45: Which of the following equations is INCORRECT? Q46: A stock market comprises 2400 shares of Q47: Which of the following statements is FALSE? Q49: Use the table for the question(s) below. Q50: A stock market comprises 4700 shares of Q51: Consider the following expected returns, volatilities, and Q52: Consider the following returns: Q53: A stock market comprises 4600 shares of![]()

A)

A)

Consider![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents