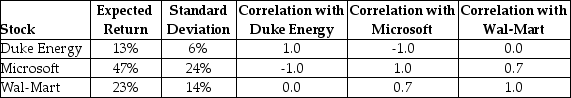

Consider the following expected returns, volatilities, and correlations:  The expected return of a portfolio that is equally invested in Duke Energy and Microsoft is closest to ________.

The expected return of a portfolio that is equally invested in Duke Energy and Microsoft is closest to ________.

A) 15%

B) 14%

C) 30%

D) 45%

Correct Answer:

Verified

Q13: Which of the following statements is FALSE?

A)A

Q55: Consider the following returns: Q56: If you build a large enough portfolio, Q58: Which of the following statements is FALSE? Q59: Which of the following statements is FALSE? Q61: A linear regression was done to estimate Q62: For each 1% change in the market Q63: You observe that AT&T stock and the Q64: If you build a large enough portfolio, Q65: A linear regression to estimate the relation![]()

A)

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents