Use the table for the question(s) below.

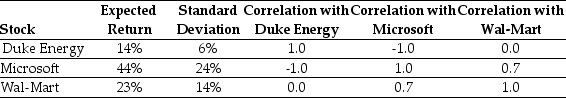

Consider the following expected returns, volatilities, and correlations:

-What is the lowest risk possible by selecting two stocks that are perfectly negatively correlated?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q36: If two stocks are perfectly negatively correlated,

Q37: What role does the correlation of two

Q38: Suppose you invest $20,000 by purchasing 200

Q39: Correlation is the degree to which the

Q40: Suppose you invest $20,000 by purchasing 200

Q42: A stock market comprises 2100 shares of

Q43: Use the table for the question(s) below.

Consider

Q44: Consider the following returns: Q45: Which of the following equations is INCORRECT? Q46: A stock market comprises 2400 shares of![]()

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents