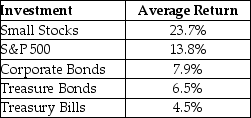

Consider the following average annual returns:  What is the excess return for the S&P 500?

What is the excess return for the S&P 500?

A) 11.5%

B) 16.3%

C) 0%

D) 9.3%

Correct Answer:

Verified

Q54: Which of the following statements is FALSE?

A)Expected

Q64: Rational investors may be willing to choose

Q65: There is an overall relationship between _

Q66: Is volatility a reasonable measure of risk

Q67: There is a clear link between the

Q68: The risk that inflation rates are likely

Q70: A portfolio of stocks where each stock

Q72: Historical evidence on the returns of large

Q73: While _ seems to be a reasonable

Q74: Consider the following average annual returns:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents