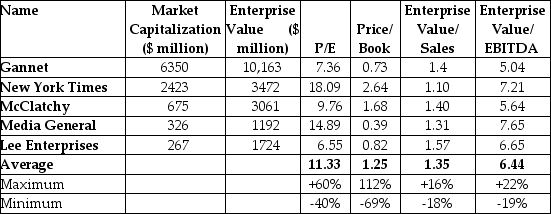

Use the table for the question(s) below.

-The table above shows the stock prices and multiples for a number of firms in the newspaper publishing industry. Another newspaper publishing firm (not shown) had sales of $620 million, EBITDA of $81 million, excess cash of $62 million, $11 million of debt, and 120 million shares outstanding. If the firm had an EPS of $0.41, what is the difference between the estimated share price of this firm if the average price-earnings ratio is used and the estimated share price if the average enterprise value/EBITDA ratio is used?

A) -$0.08

B) -$0.13

C) -$1.27

D) -$1.39

Correct Answer:

Verified

Q20: Gonzales Corporation generated free cash flow of

Q21: On a certain date, Kastbro has a

Q22: Which is the best valuation technique when

Q23: Valuation models use the relationship between share

Q24: Advanced Chemical Industries is awaiting the verdict

Q26: On a particular day, a mining company

Q27: Which of the following should be done

Q28: Which of the following statements is FALSE?

A)

Q29: Which of the following is the best

Q30: Praetorian Industries will pay a dividend of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents