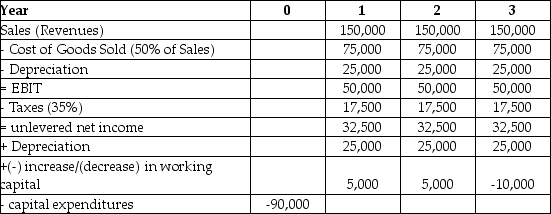

Epiphany Industries is considering a new capital budgeting project that will last for three years. Epiphany plans on using a cost of capital of 12% to evaluate this project. Based on extensive research, it has prepared the following incremental cash flow projects:  The net present value (NPV) for Epiphany's Project is closest to ________.

The net present value (NPV) for Epiphany's Project is closest to ________.

A) $23,387

B) $140,319

C) $46,773

D) $93,546

Correct Answer:

Verified

Q44: Bubba Ho-Tep Company reported net income of

Q45: Your firm is considering building a new

Q46: You are considering adding a microbrewery onto

Q47: Q48: A firm is considering changing their credit Q50: The Sisyphean Corporation is considering investing in Q51: Epiphany Industries is considering a new capital Q52: The Sisyphean Company is considering a new Q53: You are considering adding a microbrewery onto Q54: Temporary Housing Services Incorporated (THSI) is considering![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents