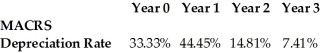

A fast-food company invests $2.2 million to buy machines for making slurpees. These can be depreciated using the MACRS schedule shown above. If the cost of capital is 10%, what is the increase in the net present value (NPV) of the product gained by using MACRS depreciation over straight-line depreciation for three years?

A fast-food company invests $2.2 million to buy machines for making slurpees. These can be depreciated using the MACRS schedule shown above. If the cost of capital is 10%, what is the increase in the net present value (NPV) of the product gained by using MACRS depreciation over straight-line depreciation for three years?

A) $28,559

B) $47,599

C) $76,158

D) $190,321

Correct Answer:

Verified

Q29: Which of the following is an example

Q59: Luther Industries has outstanding tax loss carryforwards

Q60: The Sisyphean Corporation is considering investing in

Q61: An announcement by the government that they

Q62: Q63: A company spends $20 million researching whether Q65: Firms should use the most accelerated depreciation![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents