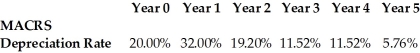

A bakery invests $40,000 in a light delivery truck. This was depreciated using the five-year MACRS schedule shown above. If the company sold it immediately after the end of year 2 for $21,000, what would be the after-tax cash flow from the sale of this asset, given a tax rate of 40%?

A bakery invests $40,000 in a light delivery truck. This was depreciated using the five-year MACRS schedule shown above. If the company sold it immediately after the end of year 2 for $21,000, what would be the after-tax cash flow from the sale of this asset, given a tax rate of 40%?

A) $11,520

B) $9480

C) $3792

D) $17,208

Correct Answer:

Verified

Q29: Which of the following is an example

Q68: What are the most difficult parts of

Q69: Joe pre-orders a non-refundable movie ticket. He

Q70: If a business owner is using the

Q71: What is the most important function of

Q73: An insurance office owns a large building

Q74: A firm is considering a new project

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents