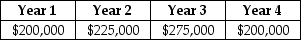

The Sisyphean Company is planning on investing in a new project. This will involve the purchase of some new machinery costing $420,000. The Sisyphean Company expects cash inflows from this project as detailed below:  The appropriate discount rate for this project is 16%.

The appropriate discount rate for this project is 16%.

The net present value (NPV) for this project is closest to ________.

A) $206,265

B) $144,385

C) $515,661

D) $216,578

Correct Answer:

Verified

Q34: Q35: A manufacturer of video games develops a Q36: Consider the following two projects: Q37: Use the information for the question(s) below. Q38: A bakery is deciding whether to buy Q40: The internal rate of return (IRR) is Q41: A convenience store owner is contemplating putting Q42: The Sisyphean Company is planning on investing Q43: A lottery winner can take $6 million Q44: Which of the following is NOT a![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents