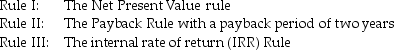

Mary is in contract negotiations with a publishing house for her new novel. She has two options. She may be paid $100,000 up front, and receive royalties that are expected to total $26,000 at the end of each of the next five years. Alternatively, she can receive $200,000 up front and no royalties. Which of the following investment rules would indicate that she should take the former deal, given a discount rate of 8%?

A) Rule I only

B) Rule III only

C) Rule II and III

D) Rule I and II

Correct Answer:

Verified

Q47: An investor is considering a project that

Q48: A mining company plans to mine a

Q49: Which of the following statements is FALSE?

A)

Q50: Use the information for the question(s) below.

Q51: Consider the following two projects:

Q53: What is the internal rate of return

Q54: Use the information for the question(s) below.

Q55: Consider a project with the following cash

Q56: According to Graham and Harvey's 2001 survey

Q57: Consider the following two projects:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents