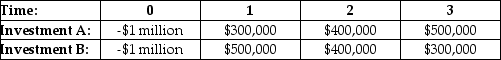

An investor is considering the two investments shown above. Her cost of capital is 8%. Which of the following statements about these investments is true?

An investor is considering the two investments shown above. Her cost of capital is 8%. Which of the following statements about these investments is true?

A) The investor should take investment A since it has a greater net present value (NPV) .

B) The investor should take investment A since it has a greater internal rate of return (IRR) .

C) The investor should take investment B since it has a greater net present value (NPV) .

D) The investor should take investment B since it has a greater internal rate of return (IRR) .

Correct Answer:

Verified

Q74: You are considering investing in a zero-coupon

Q75: The following show four mutually exclusive investments.

Q76: Q77: What is the decision criterion while using Q78: A company has identified the following investments Q80: Consider the following two projects: Q81: You can evaluate alternative projects with different Q82: When comparing two projects with different lives, Q83: When different projects put different demands on Q84: How do you apply the Net Present![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents