Use the information for the question(s) below.

-The Sisyphean Company has a bond outstanding with a face value of $1000 that reaches maturity in 5 years. The bond certificate indicates that the stated coupon rate for this bond is 8.1% and that the coupon payments are to be made semiannually. Assuming the appropriate YTM on the Sisyphean bond is 10.6%, then this bond will trade at ________.

A) a premium

B) a discount

C) par

D) none of the above

Correct Answer:

Verified

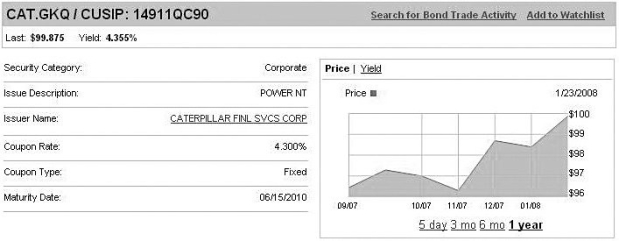

Q42: Use the information for the question(s) below.

Q43: What is the yield to maturity of

Q44: Use the information for the question(s) below.

Q45: What must be the price of a

Q46: What must be the price of a

Q48: What is the yield to maturity of

Q49: Use the information for the question(s) below.

Q50: Bond traders generally quote bond yields rather

Q51: What is the coupon rate of an

Q52: Use the information for the question(s) below.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents