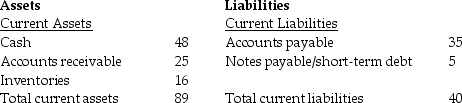

Balance Sheet

Net property, plant,

Net property, plant, The above diagram shows a balance sheet for a certain company. All quantities shown are in millions of dollars. How would the balance sheet change if the company's long-term assets were judged to depreciate at an extra $5 million per year?

The above diagram shows a balance sheet for a certain company. All quantities shown are in millions of dollars. How would the balance sheet change if the company's long-term assets were judged to depreciate at an extra $5 million per year?

A) Net property, plant, and equipment would rise to $126 million, and total assets and stockholders' equity would be adjusted accordingly.

B) Net property, plant, and equipment would fall to $116 million, and total assets and stockholders' equity would be adjusted accordingly.

C) Long-term liabilities would rise to $131 million, and total liabilities and stockholders' equity would be adjusted accordingly.

D) Long-term liabilities would fall to $111 million, and total liabilities and stockholders' equity would be adjusted accordingly.

Correct Answer:

Verified

Q9: A 30-year mortgage loan is a:

A)long-term liability.

B)current

Q15: Accounts payable is a:

A)long-term liability.

B)current asset.

C)long-term asset.

D)current

Q27: The income statement reports the firm's revenues

Q28: Income Statement for CharmCorp: Q29: What is a firm's net income? Q30: What is a firm's gross profit? Q31: Gross profit is calculated as _. Q35: Which of the following is NOT an Q36: Which of the following is NOT considered Q37: Balance Sheet ![]()

A) the

A) the

A) total![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents