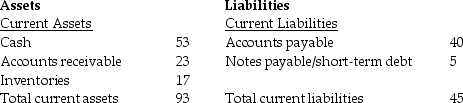

Balance Sheet

Net property, plant,

Net property, plant, The above diagram shows a balance sheet for a certain company. All quantities shown are in millions of dollars. If the company has 5 million shares outstanding, and these shares are trading at a price of $6.39 per share, what does this tell you about how investors view this firm's book value?

The above diagram shows a balance sheet for a certain company. All quantities shown are in millions of dollars. If the company has 5 million shares outstanding, and these shares are trading at a price of $6.39 per share, what does this tell you about how investors view this firm's book value?

A) Investors consider that the firm's market value is worth very much less than its book value.

B) Investors consider that the firm's market value is worth less than its book value.

C) Investors consider that the firm's market value and its book value are roughly equivalent.

D) Investors consider that the firm's market value is worth more than its book value.

Correct Answer:

Verified

Q8: What are the four financial statements that

Q17: What is the main problem in using

Q18: In the United States, publicly traded companies

Q19: Which of the following best describes why

Q21: Which of the following statements regarding the

Q23: The major components of stockholders' equity are

Q24: Balance Sheet Q25: Which of the following statements regarding the Q26: Balance Sheet Q27: The income statement reports the firm's revenues![]()

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents