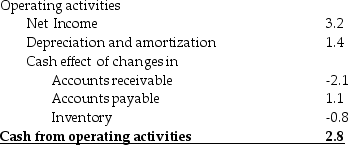

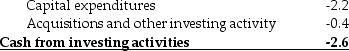

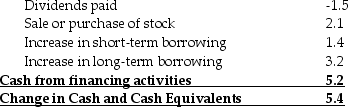

AOS Industries Statement of Cash Flows for 2008  Investment activities

Investment activities Financing activities

Financing activities Consider the above statement of cash flows. In 2008, AOS Industries had contemplated buying a new warehouse for $3 million, the cost of which would be depreciated over 10 years. If AOS Industries has a tax rate of 25%, what would be the impact for the amount of cash held by AOS at the end of the 2008?

Consider the above statement of cash flows. In 2008, AOS Industries had contemplated buying a new warehouse for $3 million, the cost of which would be depreciated over 10 years. If AOS Industries has a tax rate of 25%, what would be the impact for the amount of cash held by AOS at the end of the 2008?

A) It would have $3,000,000 less cash at the end of 2008.

B) It would have $2,925,000 less cash at the end of 2008.

C) It would have $1,500,000 less cash at the end of 2008.

D) It would have an additional $7,500,000 in cash at the end of 2008.

Correct Answer:

Verified

Q55: Use the table for the question(s) below.

AOS

Q56: What will be the effect on the

Q57: Which of the following is NOT a

Q58: How does a firm select the dates

Q59: A manufacturer of plastic bottles for the

Q61: Use the table for the question(s) below.

Income

Q62: Use the table for the question(s) below.

Q63: Use the table for the question(s) below.

Balance

Q64: GenCorp. has a total debt of $140

Q65: Use the table for the question(s) below.

Balance

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents