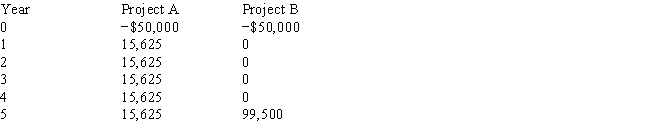

Two projects being considered are mutually exclusive and have the following projected cash flows:  If the required rate of return on these projects is 10 percent, which would be chosen and why?

If the required rate of return on these projects is 10 percent, which would be chosen and why?

A) Project B because of higher NPV.

B) Project B because of higher IRR.

C) Project A because of higher NPV.

D) Project A because of higher IRR.

E) Neither, because both have IRRs less than the required return.

Correct Answer:

Verified

Q41: The Seattle Corporation has been presented with

Q43: Which of the following statements is correct?

A)

Q48: The Seattle Corporation has been presented with

Q50: If a typical U.S. company uses the

Q54: Lloyd Enterprises has a project which has

Q54: Your assistant has just completed an analysis

Q57: As the director of capital budgeting for

Q58: Carolina Insurance Company,an all-equity life insurance firm,is

Q60: If a company uses the same discount

Q61: Real Time Systems Inc.is considering the development

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents