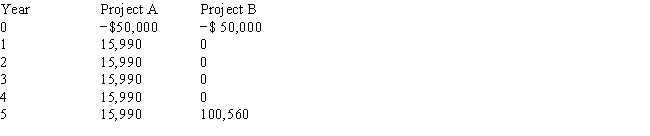

Two projects being considered are mutually exclusive and have the following projected cash flows:  At what rate (approximately) do the NPV profiles of Projects A and B cross?

At what rate (approximately) do the NPV profiles of Projects A and B cross?

A) 6.5%

B) 11.5%

C) 16.5%

D) 20.0%

E) The NPV profiles of these two projects do not cross.

Correct Answer:

Verified

Q67: Stanton Inc.is considering the purchase of a

Q69: Sun State Mining Inc. ,an all-equity firm,is

Q72: Genuine Products Inc.requires a new machine.Two companies

Q73: Two fellow financial analysts are evaluating a

Q74: Alabama Pulp Company (APC) can control its

Q75: Klott Company encounters significant uncertainty with its

Q75: Mom's Cookies Inc.is considering the purchase of

Q78: The Unlimited, a national retailing chain, is

Q79: Two projects being considered by a firm

Q87: Truck Acquisition

You have been asked by the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents