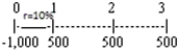

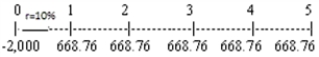

Your company is choosing between the following non-repeatable, equally risky, mutually exclusive projects with the cash flows shown below.Your required rate of return is 10 percent.How much value will your firm sacrifice if it selects the project with the higher IRR? Project S:  Project L:

Project L:

A) $243.43

B) $291.70

C) $332.50

D) $481.15

E) $535.13

Correct Answer:

Verified

Q62: Topsider Inc.is considering the purchase of a

Q69: Sun State Mining Inc. ,an all-equity firm,is

Q75: Mom's Cookies Inc.is considering the purchase of

Q78: The Unlimited, a national retailing chain, is

Q79: Two projects being considered by a firm

Q86: Foster Industries has a project which has

Q87: Truck Acquisition

You have been asked by the

Q88: A company is analyzing two mutually exclusive

Q96: Your company is planning to open a

Q100: Real Time Inc.

The president of Real Time

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents