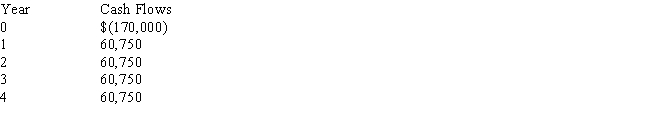

Union Atlantic Corporation, which has a required rate of return equal to 14 percent, is evaluating a capital budgeting project that has the following characteristics:  Union Atlantic's capital budgeting manager has determined that the project's net present value is $7,008.According to this information, which of the following statements is correct?

Union Atlantic's capital budgeting manager has determined that the project's net present value is $7,008.According to this information, which of the following statements is correct?

A) The project's internal rate of return (IRR) must be greater than 14 percent.

B) The project's discounted payback must be less that its economic life.

C) The project should be purchased by Union Atlantic.

D) All of these statements are correct.

E) None of these statements is correct.

Correct Answer:

Verified

Q83: You will receive a $100 annual perpetuity,the

Q85: Hillary is trying to determine the cost

Q86: Discounted payback's primary advantage over traditional payback

Q88: Your employer has agreed to make 80

Q89: If the NPV for a project is

Q92: The _ involves comparing the actual results

Q97: Which of the following statements concerning the

Q104: The greater the number of compounding periods

Q109: Suppose an investor can earn a steady

Q110: All other factors held constant,the present value

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents